David Jenkins

|

| posted on 1/7/10 at 02:43 PM |

|

|

Loan sharks

I just saw an ad on TV for a loan company that specialises in short-term loans - CashCall, or CashQuick, or similar.

Hidden away in the text at the bottom of the screen it says "typical APR 2278%" - that's right - two thousand, two hundred and

seventy-eight percent per annum, secured against your home.

How can people be so stupid to fall for that! And how is it even regarded as legal and decent?

|

|

|

|

|

cd.thomson

|

| posted on 1/7/10 at 02:51 PM |

|

|

how else can i book my holiday to benidorm when I've spent all my JSA on fags?

just to add: don't worry, I'll just set up an individual voluntary agreement in 6 months time and spend the next 50 years paying a

fraction of the money back

[Edited on 1/7/10 by cd.thomson]

Craig

|

|

|

m8kwr

|

| posted on 1/7/10 at 02:53 PM |

|

|

QUICKQUID

|

|

|

Charlie_Zetec

|

| posted on 1/7/10 at 02:53 PM |

|

|

As always, it's the smallprint that will catch people out; by making it available, if the person wanting the loan hasn't read the

specifics, it's their own fault. That doesn't make it right or even decent though, and unfortunately it's the people already

hard-hit that will apply for these loans, thus pushing themselves further into debt.

I think these organisations should be banned, as it is detremental to anyone applying, and really ios taking advantage of the poorest. Having been a

student for four years and lived in debt, then getting a mortgage, I know times are tough, but I've always tried hard (cough, cough) to live

within my means.

Artificial intelligence is no match for natural stupidity!

|

|

|

02GF74

|

| posted on 1/7/10 at 02:54 PM |

|

|

you don't understand what it is like being a single mother with 5 kids by 7 different fathers all under the age of 9 (the kids that is, not the

fathers  ) all screaming out for nintendo, ipads, Wii and flat screen telly, you'd do anything to shut them up. ) all screaming out for nintendo, ipads, Wii and flat screen telly, you'd do anything to shut them up.

|

|

|

jossey

|

| posted on 1/7/10 at 02:54 PM |

|

|

APR on short term loans with built in admin fees are always high.

its irrelavent on short term loans.

Apples Pears and Rasberries.

if you get £10 out of a chargeable cash machine your charges 20% which is as bad as the 2000 apr.

anyway thats my 2 penny worth.

i worked as a advisor for welcome finance before it went under and although the pricing isnt the best it saved a huge amount of people from losing

there home.

if you needed £20 to get you food till pay day then 2000 apr aint too bad.

with the USA having a massive reccession and thousands losing there home and not eating for 3-4 days with small kids i dont see the issue with a

company offering the small term loans.

im not in finance anymore im a consultant for a IT specialist so im not bias anymore.

|

|

|

daviep

|

| posted on 1/7/10 at 02:56 PM |

|

|

If somebody is stupid enough to consider something like that then they deserve the consequences.

IMO

|

|

|

BenB

|

| posted on 1/7/10 at 02:57 PM |

|

|

I couldn't believe it the first time I saw the add- had to go on their website to check. Unbelievable!

|

|

|

balidey

|

| posted on 1/7/10 at 02:59 PM |

|

|

The people that 'fall' for this kind of offer are unfortunately that sort of people that are already in debt upto their eyeballs... and

beyond.

I do part time work for a car repo company. You would not believe how many people are waaaay too much in debt. Why? Because this society as a whole

makes it so easy to get into debt.

Dutch bears have terrible skin due to their clogged paws

|

|

|

daviep

|

| posted on 1/7/10 at 03:00 PM |

|

|

quote:

Originally posted by jossey

APR on short term loans with built in admin fees are always high.

iif you needed £20 to get you food till pay day then 2000 apr aint too bad.

Then you should have budgeted better at the start of the month.

It's called "living within your means"

Britain/Europe/USA are all in such a mess because we don't want to accept that we can't have everything we want.

IMO

|

|

|

02GF74

|

| posted on 1/7/10 at 03:08 PM |

|

|

on a similar topic, how do those "cheque cashing" places operate?

It is for peeps who have been given a cheque but either don't have a bank account or else do not want to put the cheque into their account - so

the "cheque cashing" place buy the ceheque off them less some comision and the do what with the cheque? Do they rewrite the payee name so

they can cash it?

|

|

|

smart51

|

| posted on 1/7/10 at 03:09 PM |

|

|

2000 odd % PER YEAR doesn't really apply for a short term loan. The way it works is this. You want to borrow £100 for 1 week until you are

paid. They want you to pay back £116 next week to pay off the loan. That is 16% interest but a theoretical APR of 1938%. You don't actually

pay 1938% (unless you're stupid enough not to pay back until a year later) You pay 16%. Remember this is not interest as such but an admin

fee.

10% ANNUAL interest on £100 for a week would be about 18p. 18p is not worth the while of making the loan, so they charge £15 or so for their time

plus a bit for interest.

Why is it worth it? You get an unexpected bill and you look in the bank and you don't have enough to pay it. The penalty for late payment is

£30. You can borrow £100 for a week and pay £16 for the privilege. £16 is cheaper than £30. You get into big trouble if you don't pay these

short term loans back quickly. It is a dangerous game.

|

|

|

daviep

|

| posted on 1/7/10 at 03:18 PM |

|

|

quote:

Originally posted by smart51

Why is it worth it? You get an unexpected bill and you look in the bank and you don't have enough to pay it. The penalty for late payment is

£30. You can borrow £100 for a week and pay £16 for the privilege. £16 is cheaper than £30. You get into big trouble if you don't pay these

short term loans back quickly. It is a dangerous game.

This is a good example of credit getting people in to trouble.

How can you have an unexpected bill?

If you pay for things up front, and this is going to sound really radical to a large percentage of the population, save some money for

emergency/disasters then you won't need to worry.

IMO

|

|

|

02GF74

|

| posted on 1/7/10 at 03:21 PM |

|

|

quote:

Originally posted by daviep

How can you have an unexpected bill?

For example have a tyre pop due to a pothole that had appeared overnight.

|

|

|

smart51

|

| posted on 1/7/10 at 03:24 PM |

|

|

quote:

Originally posted by daviep

How can you have an unexpected bill?

Some people are not in such a well planned position as you or I. These things do sometimes happen.

quote:

Originally posted by daviep

save some money for emergency/disasters then you won't need to worry.

This is of course the ideal. It is difficult, though, when your £200 per week minimum wage income is hardly enough to pay rent AND feed and clothe

your children. If you don't have left over money, its hard to put it away.

|

|

|

David Jenkins

|

| posted on 1/7/10 at 03:55 PM |

|

|

I must admit that I'm biased - my dad brought me and my brother up with the philosophy that wanting something is fine - if you can pay for it.

If you can't afford it, save for it. If you can't afford to save for it - you don't need it.

Unless you're extremely fortunate you can't go through life without borrowing, but it's stupid to take out a loan that you

can't afford, or would place you in financial risk (especially risking your home).

|

|

|

Minicooper

|

| posted on 1/7/10 at 04:10 PM |

|

|

quote:

Originally posted by daviep

This is a good example of credit getting people in to trouble.

How can you have an unexpected bill?

If you pay for things up front, and this is going to sound really radical to a large percentage of the population, save some money for

emergency/disasters then you won't need to worry.

IMO

Sometimes events just overtake you, for instance if you have chronic heart disease and cannot under any circumstances do any type of job for a year

and a half.

My savings didn't last that long, but even I wouldn't use the sort of companies talked about in this thread

Cheers

David

|

|

|

Stott

|

| posted on 1/7/10 at 04:53 PM |

|

|

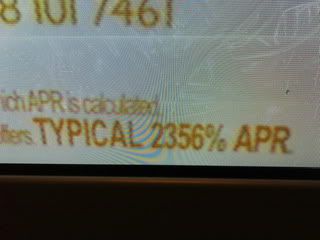

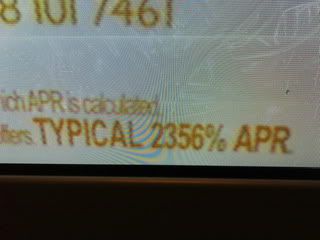

I took a pic of my tv when I saw this a few months back, mainly to read it back and make sure my eyes weren't playing tricks on me

|

|

|

hughpinder

|

| posted on 1/7/10 at 05:14 PM |

|

|

I had chronic debt when I started contracting. I had enough money to last at least 3 months normal costs. I worked for a company that agreed my hourly

rate and expenses for me to stay in a hotel (for 3 months at cost +15%admin fee). They were supposed to pay monthly in arrears, so I invoice at the

end of the first month, expecting to be paid by the end of the second month. Obviously the normal bill + staying away from home soon add up. At the

end of 4 months when the work was all done, they still hadn't paid. It was 3 months after that when I saw the first money. So it is very easy to

get into bad debt (The hotel bill was over 5 grand because I had all my meals there - until they didnt pay the first bill), even when you think you

have everything under control. The bank charges were horrendeous and even though I had up till then had a good credit rating that was wiped out. This

was with a huge multinational company that measures its profits in billions.

Hugh

|

|

|

Paul TigerB6

|

| posted on 1/7/10 at 06:51 PM |

|

|

quote:

Originally posted by Stott

I took a pic of my tv when I saw this a few months back, mainly to read it back and make sure my eyes weren't playing tricks on me

There are times when these loans are required - as said to get people through to payday etc!! Remember these loans are intended as short term - days

typically and if you'd read the site you'll see that they generally get repaid in full on the next available pay date.

Just had a look at one site - Wonga.com who advertise on tv. £100 for 7 days has a repayment of £112.78 and pays into a bank within an hour. Thats

hardly unreasonable i wouldnt say - £12.78 in charges given admin and two bank transactions - even if not ideal. 2689% APR sounds scary though!!

Whats more scary though is that the option could be an illegal loan shark who makes the rules up as he goes along.

PS my job - its a technical role at a Financial Advisers writing reports and so on so i've seen plenty of debt cases

|

|

|

iank

|

| posted on 1/7/10 at 06:55 PM |

|

|

quote:

Originally posted by hughpinder

I had chronic debt when I started contracting. I had enough money to last at least 3 months normal costs. I worked for a company that agreed my hourly

rate and expenses for me to stay in a hotel (for 3 months at cost +15%admin fee). They were supposed to pay monthly in arrears, so I invoice at the

end of the first month, expecting to be paid by the end of the second month. Obviously the normal bill + staying away from home soon add up. At the

end of 4 months when the work was all done, they still hadn't paid. It was 3 months after that when I saw the first money. So it is very easy to

get into bad debt (The hotel bill was over 5 grand because I had all my meals there - until they didnt pay the first bill), even when you think you

have everything under control. The bank charges were horrendeous and even though I had up till then had a good credit rating that was wiped out. This

was with a huge multinational company that measures its profits in billions.

Hugh

I was once told by an ex-employee of a large energy company that their official (but confidential) policy in the accounts department was payment on

second solicitors letter.

The big companies are the worst at paying late as they gain an enormous amount of interest at their contractors/suppliers expense due to the volume of

their business. If they're really "lucky" the supplier goes bust and they can wipe out, or renegotiate the debt

[Edited on 1/7/10 by iank]

--

Never argue with an idiot. They drag you down to their level, then beat you with experience.

Anonymous

|

|

|

big_wasa

|

| posted on 1/7/10 at 07:07 PM |

|

|

I did this for a living a few years back and you would be amazed at the type of person that would use the service.

All walks of life from teachers to nurses and beyond.

The real killer and the money maker was the renewal as if you didn’t have the cash this month then you wouldn’t next month either.

The firm would get an income every month for 3 minuets work. That’s until the customer goes under and the bank with draws the cheque guarantee

card.

Some lasted years earning the firm lots.

I could tell you some stories

As said its some one on the edge that has waxed every other type of credit.

|

|

|

JoelP

|

| posted on 1/7/10 at 07:14 PM |

|

|

my friend borrowed 10k from a loan shark, repaid 18k and still owed the 10k he started with. It was £500 a month in interest. He's had to duck

him now and is in hiding.

|

|

|

snapper

|

| posted on 1/7/10 at 07:56 PM |

|

|

Got stung with a store card when I had a saturday job 1 leather jacket took me years to pay back.

Many years later I was given a free overdraft equal to 2 months wages, took me years to pay back.

I think I have learnt my lesson only time will tell

I eat to survive

I drink to forget

I breath to pi55 my ex wife off (and now my ex partner)

|

|

|

Ninehigh

|

| posted on 1/7/10 at 08:15 PM |

|

|

Nothing wrong with it they display the interest rate clearly. You make damn sure you pay it back though!

I do wonder if in a few years we'll hear of people that forgot to pay it back, and the loan company didn't bother to say anything for

about 10 months then send a letter saying they owe £1800 from a £100 loan

|

|

|