Miks15

|

| posted on 6/3/14 at 09:18 AM |

|

|

Any experts on import duty?

I'm in the process of ordering a few motorbike bits from the states. Now I realise I will have to pay a little extra when they arrive in the

country, but going through the .gov website its very hard to find out any sort of rough idea of how much I will have to pay.

The guy I'm buying from said he is happy to split up the packages so each contains under a certain value of parts. Is there a value which, if

the parts total is below, I wont have to pay any tax? The total value of all of the parts I'm buying is roughly £300.

Any help on the matter would be greatly appreciated.

Thanks!

|

|

|

|

|

RickRick

|

| posted on 6/3/14 at 10:12 AM |

|

|

i think the value is around £35 to dodge import duty

if your going to get hit make sure it's only once they add on vat i think then another postage charge normaly about £8 for me with light

parcles and a handling charge about £8 too

|

|

|

Miks15

|

| posted on 6/3/14 at 10:20 AM |

|

|

Is VAT always payable no matter what? And then a possible import duty on top?

I have family in america, so would it be worth sending it to them and then getting it shipped from a private residence rather than a company?

I think I might struggle getting the guy to send it in 10 seperate boxes to get them all under £35 ha. Cheers for the info rick!

|

|

|

r1_pete

|

| posted on 6/3/14 at 10:22 AM |

|

|

I'm pretty sure the import duty and VAT limit is £15, and yes Parcelforce will rush you £8 handling if they are shipper.

I'm waiting on a duty demand at the moment for some parts I bought, just hoping USPS handle it and not ParcelFarce.

|

|

|

r1_pete

|

| posted on 6/3/14 at 10:26 AM |

|

|

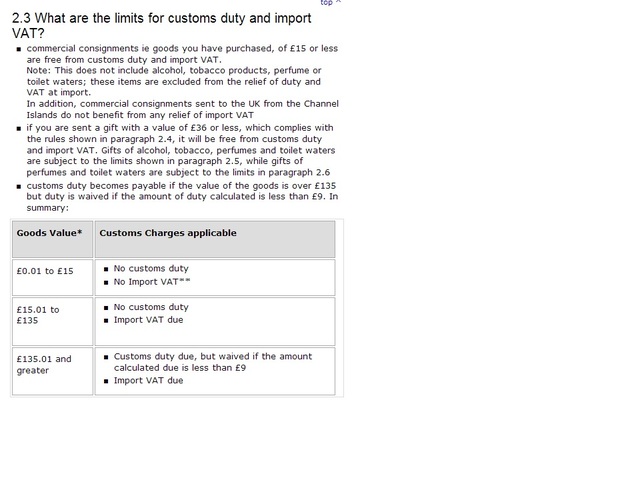

From HMRC Website:

HMRC

|

|

|

Miks15

|

| posted on 6/3/14 at 10:32 AM |

|

|

thanks pete,

so from that, it looks like under £135 I pay VAT (at 20% i presume) but no additional import duty. That might be a way of splitting it up then.

Cheers.

|

|

|

MikeRJ

|

| posted on 6/3/14 at 11:10 AM |

|

|

quote:

Originally posted by Miks15

thanks pete,

so from that, it looks like under £135 I pay VAT (at 20% i presume) but no additional import duty. That might be a way of splitting it up then.

Cheers.

Surely the courier charges are going to be much greater sending it as multiple packages?

|

|

|

Miks15

|

| posted on 6/3/14 at 11:19 AM |

|

|

Yes that is possible.

Is there anyway of knowing who it will end up being delivered by?

The guy said he will ship via the US post office, so is it likely it'll just end up in the royal mail system?

|

|

|

Oddified

|

| posted on 6/3/14 at 11:37 AM |

|

|

quote:

Originally posted by Miks15

Yes that is possible.

Is there anyway of knowing who it will end up being delivered by?

The guy said he will ship via the US post office, so is it likely it'll just end up in the royal mail system?

That will end up with Parcel Force delivering it on this side, and if it's over the 'free' limit above then it's (was a few

weeks ago any way...) £13.50 handling fee plus 20% import duty on the total (invoice value which includes the shipping plus the handling fee!). Soon

adds up

Ian

|

|

|

Miks15

|

| posted on 6/3/14 at 06:48 PM |

|

|

Cheers Ian,

Not really looking forward to the extra bill on top of what I'm paying for the bits, but looks like it cant be avoided really and just going to

have to bite the bullet as I cant get the bits anywhere as well!

Cheers all for the advice

|

|

|

r1_pete

|

| posted on 6/3/14 at 06:58 PM |

|

|

You could get around the duty.

If your family send them to you, at their post office they will have to complete a customs certificate, stating the value of the items, if they tell

the post master 'we don't know the value, they're just some old motorbike parts we are sending a relative'... and you can

afford the risk of them not being insured for the full value....

|

|

|

luke2152

|

| posted on 6/3/14 at 09:19 PM |

|

|

I've ordered a few items in the last couple of years from the states and asia. Car and bike bits. Values between about 100 and 300. Only got

a VAT bill for one item (a used ABS ecu of all things). So either I've been very lucky or a lot of the items get through unchecked.

|

|

|

Miks15

|

| posted on 6/3/14 at 09:43 PM |

|

|

OK cheers guys!

|

|

|